Lifetime ISAs vs. Pensions

by on 05·12·2017

Since April 2017, you've been able to open a Lifetime ISA if you're aged between 18 and 40. For every £4 you pay in, the government will add £1. You can pay in a maximum of £4,000 a year to receive the £1,000 bonus from the government, which will be added at the end of the tax year. You can carry on earning bonuses until you are aged 50, and continue saving after that without bonuses.

Those with a Help to Buy ISA can transfer those savings into a Lifetime ISA or continue saving into both. However, you can only use the bonus from one to buy a house. The Help to Buy ISA, will be withdrawn in November 2019.

Savers can tap into their pots if they want to use some or all of the money to buy their first home, or wait until they are 60 to withdraw cash and their bonus tax-free. You can withdraw the money at any time, but if you do so before you turn 60 or if the money is not to help by your first home, you'll have to pay a 5% charge, and you'll lose the government bonus and any interest or growth on this. This is because the savings are designed to either purchase your first home or as retirement income after the age of 60.

The government has stressed that the Lifetime ISAs are not a replacement pension but rather an additional savings vehicle.

Advantages of the Lifetime ISA:

- If you are self-employed and don't receive employer contributions into your pension

- You've already made the maximum contribution via your workplace pension and you want to supplement retirement savings. This is especially useful for high earners making between £150,000 and £210,000 a year, as their annual allowance will gradually reduce from £40,000 to £10,000

- You want to retain access to your money in case you require it in an emergency before the age of 60 (but you'll lose the government bonus and growth on the bonus, and incur a 5% penalty)

- ISAs are simple, easy to understand and popular financial products

- Any withdrawals from an ISA a tax free, whereas a pension only 25% is tax free the residual amount will be taxed at your marginal rate of tax

Advantages of the Personal Pension:

- You are in a workplace pension to which your employer contributes - under auto-enrolment rules your employer will contribute at least 4% by 2019. An employer can't make a contribution into an ISA

- You want to access your money at age 55 rather than having to wait until you turn 60

- You are a higher-rate taxpayer (and therefore qualify for pension tax relief at 40%)

- You are likely to be paying a lower rate of tax in retirement (say 20%) than you did in work, perhaps as a higher-rate taxpayer getting upfront tax relief at 40%

- You will want to make significant pension contributions past the age of 50

- You intend to make substantial contributions - the lifetime limit for a pension is £1m from April 2016, while the most you can contribute to the lifetime Isa with the bonus is £128,000

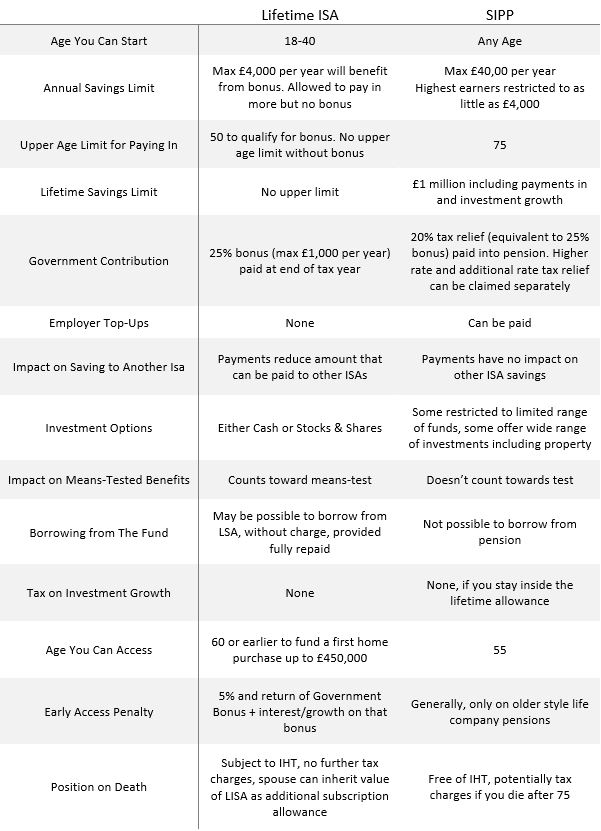

The table below from AJ Bell lays out the key differences between a Lifetime ISA and a Self-Invested Personal Pension:

In summary, an LISA is a welcome addition to the saving vehicles available to client's, but it still does not replace the benefits on a pension.