Charitable Giving & Gift Aid

by on 23·02·2016

How often do you tell your clients to give money away? This may seem counterintuitive to an adviser, particularly if you have spent years working with your client to build up savings, but if your client is a higher or additional rate tax payer this is certainly something you should look to discuss with them.

Whilst you are likely to have discussed making use of annual gift allowances and making a Will, what about charitable giving?

Most people are now aware of the Gift Aid system, but do they really understand the benefits and choices this offers? Given the choice of paying all of your income tax direct to HMRC or paying some of your money to a charity of your choice, what would you choose?

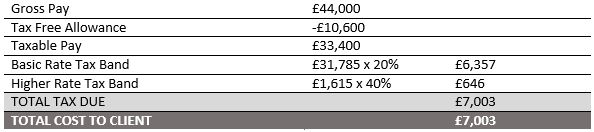

Let's see how this works. Chris is a 50 year old, higher rate tax payer with a gross income of £44,000 in 2015/16. Based on this he will pay tax as follows:

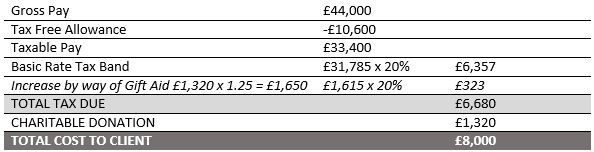

However, if he were to pay £110/month to the local donkey sanctuary using Gift Aid, and claimed this at his annual tax return, his basic rate tax band will be increased as follows:

So, the total cost to Chris of his £1,320 donation is actually only £997 (£8,000 - £7,003) and he will remain a basic rate tax payer. The additional benefit is that he has been able to re-direct a portion of his tax to a cause closer to his heart rather than HMRC's coffers.

In addition to making regular donations of cash by way of Gift Aid it is also possible to Gift Aid shares, land and goods. There is no CGT due on disposals of assets to charities, so this may be a useful option for clients to consider, rather than making cash payments which could be better used to maximise ISA or pension allowances.

With a growing number of singletons some clients may plan to leave their Estate to good causes rather than distant relatives. But why wait until you have died to give your money away? Whilst there are now incentives to leave assets to charities in your Will by way of a reduced IHT rate (36% rather than 40%), clients with adequate pension income and significant assets could look to make larger gifts during their lifetime.

Gifts into Trusts can trigger an immediate tax charge and further tax if death occurs within 7 years, but these charges do not apply on gifts to charities. It is even possible to set up your own charitable trust if you would prefer to have a more hands on approach as a Trustee. Many DFM's have specialist teams which work with philanthropic Trusts and ensure that they are managed to maximise the funds eventually passed to the good cause of your choice.

Giving money away may not be as simple as it first appears and clients will continue to seek advice to ensure that they make gifts in the most tax efficient way and that Trusts are managed to maximise their potential. We often give to charities not just to help them, but to make us feel good too. Helping your clients achieve a little 'feel good factor' could be another way to continue and strengthen your relationship with them.